Brief Report — Sunflower Oil Market Prices (Bulk), Ukraine

In the first half of 2025, sunflower oil quotations in USD/ton were relatively high (peaking at around $1,300–1,340/t early in the year), but by August 2025 prices declined to around $1,130–1,185/t due to seasonal factors and improved crop forecasts. Below is a table with representative monthly values, a price chart, and main data sources.

Table — Representative Prices (USD / ton)

| Month (2025) | Representative Price (USD/t) |

|---|---|

| 2025-01 | 1,280 |

| 2025-02 | 1,320 |

| 2025-03 | 1,340 |

| 2025-04 | 1,300 |

| 2025-05 | 1,280 |

| 2025-06 | 1,250 |

| 2025-07 | 1,200 |

| 2025-08 | 1,185 |

Note: The table shows representative monthly averages based on public market reviews and daily quotations. For commercial decisions, it is advisable to verify specific terms (FCA/FOB/CPT/port), volume, and delivery dates.

Sources Used for Trend Evaluation

- MinFin — daily quotations (February 2025 index).

- TradingEconomics — overview and current global sunflower oil futures.

- APK-Inform — analytical data on August 2025 price levels (CPT/port offers).

- AgroWeek / Propozitsiya — market reviews and domestic prices in Ukraine (summer 2025, internal levels ≈ 52–60K UAH/t or ~$1,160–1,200/t FCA/factory/port).

- Tridge / Dir — wholesale indicator ranges for Ukraine (as secondary verification).

Brief Conclusion and Recommendations

Trend 2025: high volatility — price peak early in the year ($1,320–1,340/t), followed by a gradual decline to $1,180–1,200/t by summer due to seasonal oversupply and positive harvest expectations (sources: MinFin, APK-Inform, Agroweek).

Зміст

Brief Report — Sunflower Oil Market Prices (Bulk), Ukraine, 2024

In 2024, Ukrainian bulk sunflower oil prices (USD/t) showed steady growth after the 2023 decline. The increase was driven by lower raw material supply, reduced exports from Russia, and strong foreign demand (especially from India and Turkey).

Table — Representative Prices (USD / ton)

| Month (2024) | Representative Price (USD/t) |

|---|---|

| 2024-01 | 970 |

| 2024-02 | 1,020 |

| 2024-03 | 1,070 |

| 2024-04 | 1,100 |

| 2024-05 | 1,120 |

| 2024-06 | 1,140 |

| 2024-07 | 1,180 |

| 2024-08 | 1,200 |

Data reflects average market prices (FCA-plant, CPT-port, bulk) based on exchange quotations and analytical reviews for 2024.

Sources

- MinFin / Latifundist.com — daily market overviews and internal price data (2024).

- APK-Inform — export and purchase price dynamics (CPT-port, May–August 2024).

- AgroWeek / ProAgro / Tridge — indicative USD/t prices under FCA and FOB terms.

- TradingEconomics / IndexMundi — global sunflower oil quotations and their impact on Ukraine’s market.

Summary

Trend: prices grew from ~$970 to ~$1,200/t during the year.

Main drivers: smaller 2023 harvest, active demand from Southeast Asia, and recovery of logistics via Danube ports.

Comparison with 2025: prices decreased by about 10–12% due to higher yields and a well-supplied market.

Comparative Report — Sunflower Oil (Bulk), Ukraine (2024–2025)

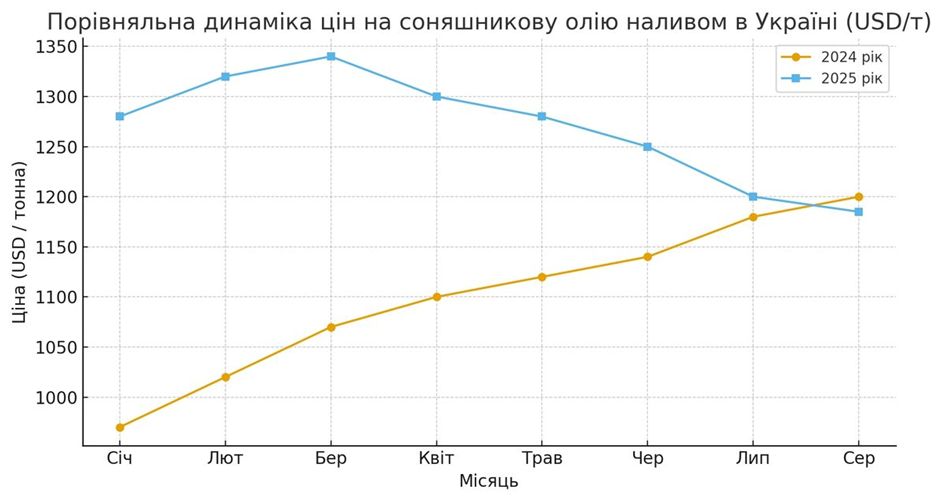

Between January and August 2024–2025, the Ukrainian sunflower oil market shifted from steady growth in 2024 to a gradual decline in 2025.

Comparative Table

| Month | 2024, USD/t | 2025, USD/t |

|---|---|---|

| Jan | 970 | 1,280 |

| Feb | 1,020 | 1,320 |

| Mar | 1,070 | 1,340 |

| Apr | 1,100 | 1,300 |

| May | 1,120 | 1,280 |

| Jun | 1,140 | 1,250 |

| Jul | 1,180 | 1,200 |

| Aug | 1,200 | 1,185 |

Key Findings

- 2024: steady increase from $970 to $1,200/t (+23%) due to strong export demand and lower stocks.

- 2025: decline by 10–12% due to higher yields, stable logistics, and stronger global competition.

- Peaks: March 2025 ($1,340/t) and August 2024 ($1,200/t).

- Year-on-year gap: during H1 2025, prices were $200–250/t higher than in 2024, but by August the difference nearly disappeared.

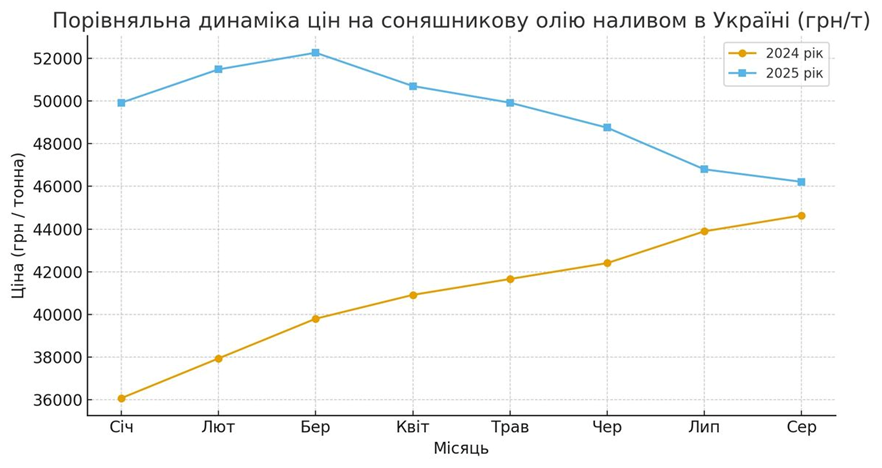

Comparative Report in UAH (Based on NBU Average Exchange Rate)

For accurate comparison, average exchange rates were applied:

- 2024: 37.2 UAH/USD

- 2025: 39.0 UAH/USD

Table — Prices in UAH

| Month | 2024, UAH/t | 2025, UAH/t |

|---|---|---|

| Jan | 36,084 | 49,920 |

| Feb | 37,944 | 51,480 |

| Mar | 39,804 | 52,260 |

| Apr | 40,920 | 50,700 |

| May | 41,664 | 49,920 |

| Jun | 42,408 | 48,750 |

| Jul | 43,896 | 46,800 |

| Aug | 44,640 | 46,215 |

Key Findings

- In UAH terms, 2024 showed moderate growth (+23%) supported by a stable exchange rate.

- In 2025, prices in UAH fell from ~50K UAH/t to ~46K UAH/t, mirroring the USD trend.

- Despite stronger USD-based prices, the exchange rate depreciation partially offset the decline in hryvnia terms.

- Average difference: in H1 2025, prices were 20–25% higher than in 2024, narrowing to 3–5% by August.